In spite of the pandemic scare on our research survey, we were successfully able to complete the survey across states of Karnataka, Maharashtra, Gujarat and NCR markets — covering 416 Micro, Small and Medium Enterprises (MSMEs) in rural, semi-urban and urban markets. Of course, reaching out to only rural MSMEs was limited due to the digital nature of the survey, we managed to clock about 25% of the survey from the rural MSME market.

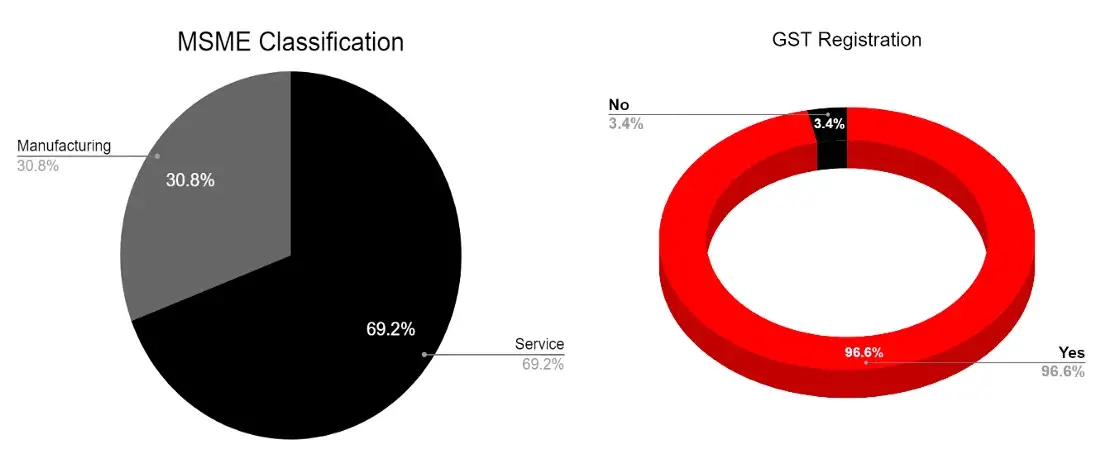

The survey covered 416 MSMEs, of which 31% were Manufacturing MSMEs and 69% were service based MSMEs. Interestingly, close to 97% of them had a Goods and Services Tax (GST) registration. This clearly indicated the possible use of GST as a single identifier for an enterprise in all transactions. This could clearly pave the way for easy transaction-based banking solutions across the board. MSMEs across the country struggle with very few trade-based and transaction-based products on offer from the traditional institutions. The availability of the unique identifier such as GST — makes it easy for the institutions to create products that are similar to the letter of credit, letter of credit discounting and so on. This helps the MSMEs to grow in their scale as their cost of funds considerably comes down. On the other hand, the banks could also enjoy a better income, due to the transactional fee that could be charged with these products. We plan to talk about the product use cases in our next blog.

As we glanced through the series of our collected data, we could trace the various personas of the MSME that existed in the country.

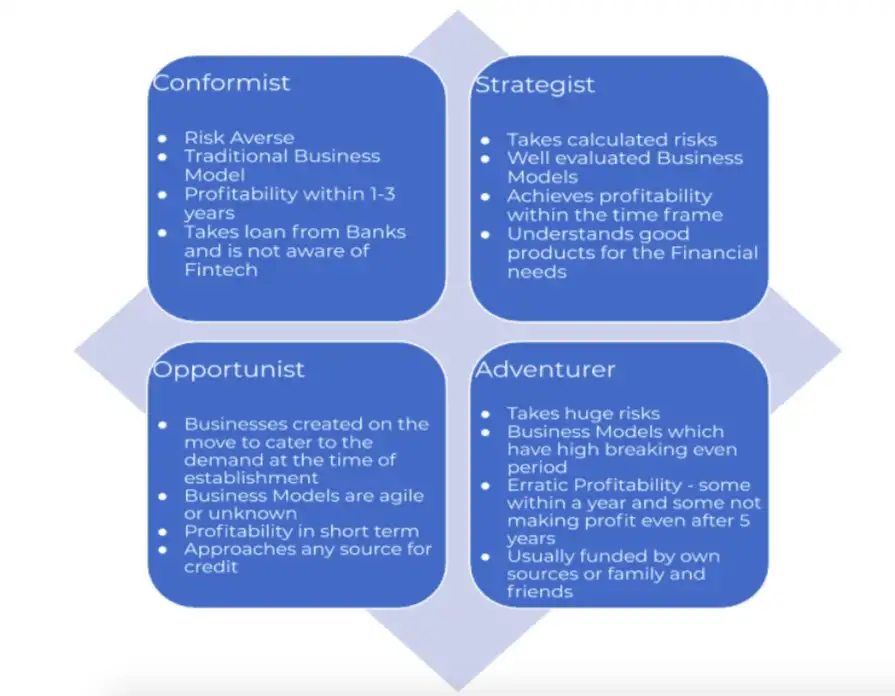

These personas were arrived at, based on the parameters of — Risk Appetite, Business Model, Profitability and Sources of Financing for their business. Risk taking capability was seen from the turnover, business model and, the time point at which current ratio of unity (current ratio of 1) — which is the basic criteria for working capital lending across banks — was achieved. Business Model could be gauged through the sector that they served, superficially speaking whether they were Service sector or Manufacturing sector. The business model of the Service sector appeared to be simpler as compared to that of Manufacturing. For example, a trader profile MSME in the service sector will deal with inventory and receivables on one side while the creditors are on the other side of the balance sheet. However in the manufacturing sector, inventory itself is highly complicated to understand. With raw material inventory, work-in-progress and finished goods inventory as its components, the promoter hardly has clear visibility of the entire picture: provided he is not a seasoned entrepreneur. Profitability of the businesses was taken into account where it was applicable. And lastly, we looked at what the sources of funding were for these MSMEs.

We observed that only 174 out of 416 respondents confirmed taking a loan either from the organised sector through institutions like Bank or NBFC; or from unorganised sector like family and friends. It is interesting to observe that most of the firms tend to be profitable within three years of operation, a few becoming profitable within a year of operation.

Keeping such data points in mind, we have drawn four personas for the MSME. We would bring out more detailed analysis on each persona and a possible use case that could be associated with them. Doing a brief description-analysis on the survey data, we could figure out that there are four personas attached to the MSMEs — Conformist, Strategist, Opportunist and Adventurer. We would like to quickly take you through the MSMEs and their personas.

These personas help to create risk scores which could be mapped to the risk-taking ability and business models of the MSMEs. Persona with the grid offered by the Government classification of MSME into Yuva, Kishore and Tarun MSME — would be the base on which we would develop our model of credit assessment and come up with potential use cases.