Enterprises start out of dreams and are nurtured through insights of the founders. Due to lack of trained resources, many enterprises do not last long: as it is limited to the founder and the few concerned. Even among fortune 500 companies, many slip positions or some even fade away due to various reasons. An important reason for this — firms run as proprietorship. MSMEs are no exception to this. It is rare to find an enterprise registered as a limited company, especially in micro and small segments of enterprises. This indeed cripples the financial health of the enterprise, with no demarcation between the personal and enterprise level finance. In order to understand the behavior, we studied the secondary data of Business Loans (BL), Personal Loans (PL) and Loan Against Property (LAP) which form the entry level options in financing, for budding enterprises.

In mass market segment, the overall composition is tilted towards the Personal Loan segment. This is easily available and the end use of the loan is not restricted. However, it is interesting to note that the developed and more industrialised states have a better share in Business loans and Loan against property. These products are much better than the personal loan, as it has an utility check and can be used for both business and personal purposes.

In states of our study i.e Karnataka, Tamil Nadu, Maharashtra and Gujarat — the more industrialised ones, we can see from the composition of credit off-take, the Business Loan to be more significant when compared to the lesser industrialised states.

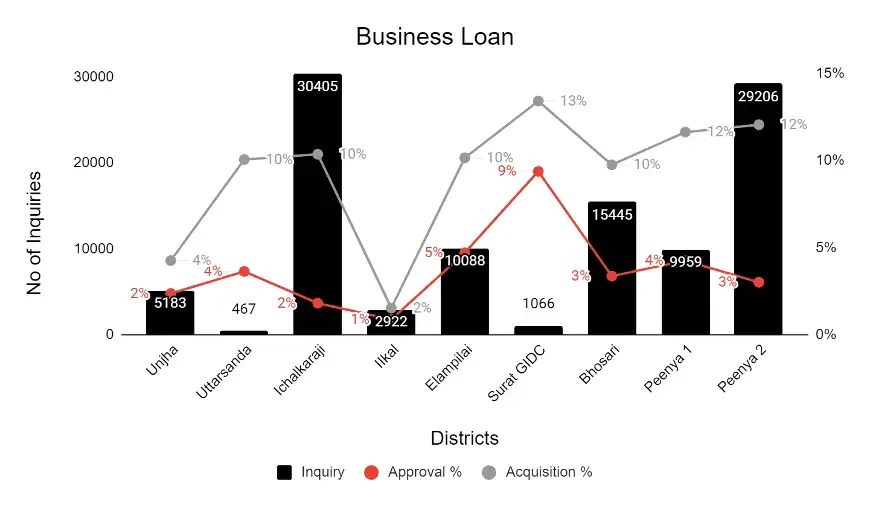

We further moved to identify certain geographies which are ‘islands of prosperity’ across the country, better known as clusters under different MSME activity; only to find some interesting credit behavior. Certain clusters which are distinctly recognised for power loom and handloom (Ilkal, Ichalkaranji, and Elampillai), few with agro based industries (Unjha and Uttarsanda), and clusters which have manufacturing dominance (Peenya, Bhosari, Surat) were studied to understand the varied credit behavior.

We studied the inquiries for the said products, with respect to the sanction (approval rate) and disbursements done (acquisition).

We were left with intriguing questions on trends in the respective industries represented by these islands:

Loom based clusters have higher Personal Loans. Ilkal (Karnataka), Elampillai (TN) and Ichalakaranji (MH) are textile hubs and have higher disbursements in personal loan. Does this explain anything about the apathy of textile Industry in India?

Unjha and Uttarsanda which are Agri and Agro based enterprise clusters are agnostic between the types of loans but may have evolved subsidy-based loans. Does this explain state dependency for agro based industries and making them more sensitive to prices, EXIM policies?

In manufacturing dominated areas like Bhosari (Maharashtra) and Peenya (Karnataka) there are higher enquiries and disbursements in property-based Business Loans (LAP and BL). Are mortgage-based loans a limiting factor for manufacturing enterprises?

None of the above said credit facilities substitute for the working capital-based financing which streamlines the enterprises and builds financial robustness. But this is easier said than done. Enterprises need credit while they are young. They end up turning to higher cost products such as loan against property, business loans and in dire circumstances even go for personal loans.

Financial Institutions have created these products with salaried segment in mind but have now tweaked them for enterprises; which in the long run destabilises the finances for MSME. Continuing our study on sustainable MSME financing, we would direct our focus on building a credit assessment model that redefines the traditional underwriting norms — by carefully examining the journey of enterprises from just-born startups to an established well run MSME. We would try to understand when these enterprises crossed the golden line of credit accessibility, from availing consumer-based loans to enterprise loans and its effect on the inventory and efficiency of the enterprise.

Notes

*All graphs are from the data derived from the analysis of Pin Code wise Credit Bureau data as of Dec 2019. (CIBIL)