Last year around this time if you would have asked any VC investor about the alternative protein sector or vegan meat products, it would have been a reflex movement to brag all about the success of Beyond Meat, the poster boy of vegan meat. But we have come a long way since then, and this is how!

The reasons why we can’t continue to meat like this

Protein is widely known to be an important part of the human diet and an essential building block of bones, muscles, cartilage, skin and blood. Animal-based foods are more commonly considered to be superior sources of protein a.k.a. “complete proteins” (containing all the essential amino acids).

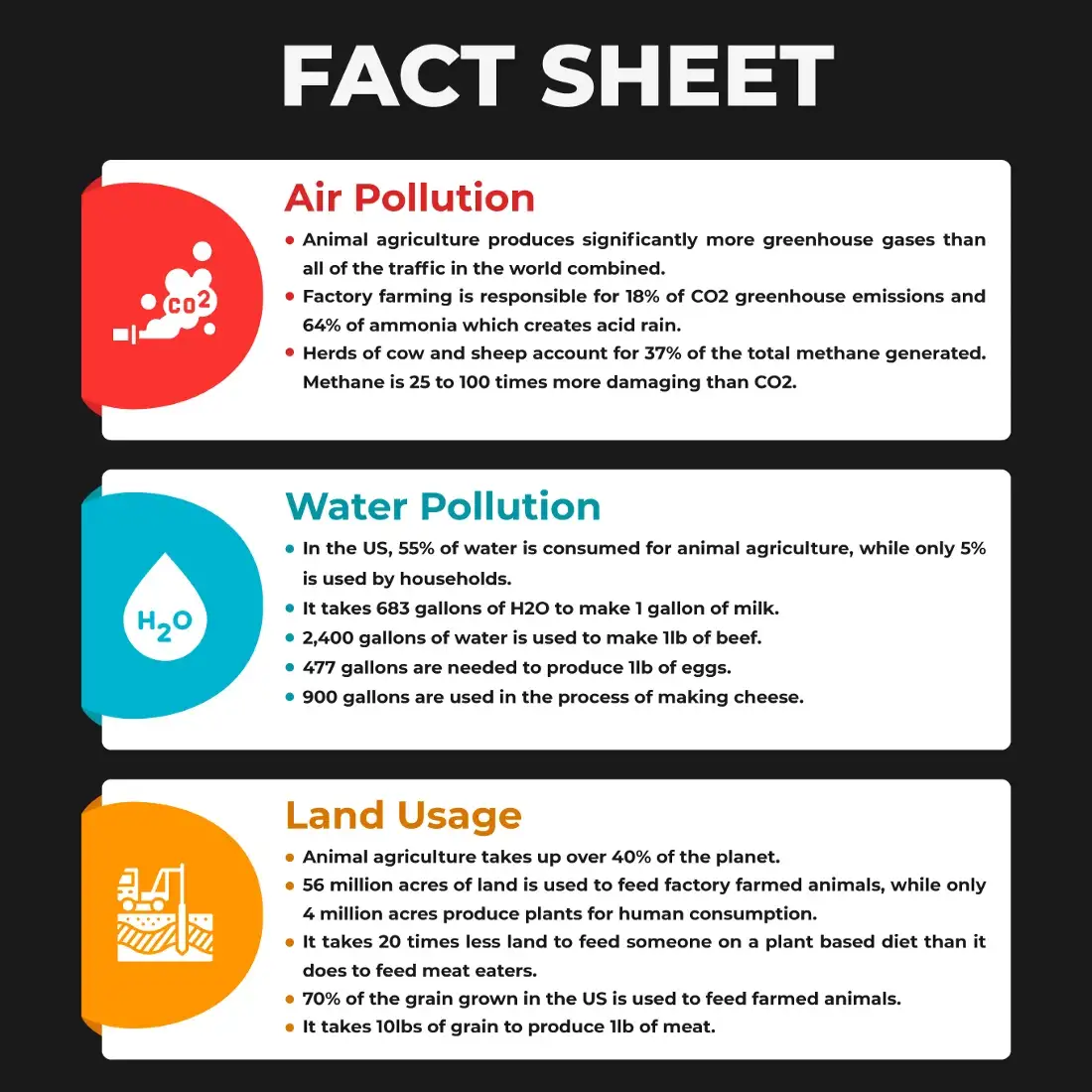

However, rearing of livestock and consumption of animal-based foods have a negative impact on the environment and human health, respectively. As much as 80% of the Amazon Rainforest has already been destroyed and now occupied by pastures and feed crops [1]. Heavy usage of antibiotics for farm animals is believed to be a significant factor in the rapid growth of antimicrobial resistance (AMR). This leaves humans exposed to serious though previously curable, bacterial diseases.

A global opportunity!

Despite challenges, the consumption of these products is at an all-time high! When compared with 2012 levels — the production and demand for meat is expected to rise more than 50% by 2050 [3] and the reason for an unprecedented surge in demand could be attributed to a combination of population growth, rising incomes and urbanisation.

The global population is forecasted to reach almost 10 billion by 2050 [4]. To sustainably feed the world tomorrow, we need to build and support innovative ways to grow our food today.

Interestingly, in recent times there has been an uptick in the conversations about these animal-based foods posing a harm to human and planetary health. And as more people opt for a switch to veganism or vegetarianism — the need for innovation in alternative sources of protein and its products can only be on the rise.

What do we mean by Alternative Protein Products?

Alternative Protein Products is a commonly used term that includes both plant based and lab grown substitutes to animal-based food products. These substitute products not only include meat, but also other animal-based foods such as egg, seafood, milk and dairy products.

The basic difference between a plant based product and lab grown product is the category of ingredients or inputs used and hence, the relevant application of science and technology, to convert it into a final product.

We have attempted to simplify it as below:

Evolution of the Alternative Protein sector

Even though several leading companies established in the US during the 1970s-90s had started supplying the veggie burgers (or bean burgers), these products were not meant to mimic the taste of meat. The plant-based meat category took off when Beyond Meat and Impossible Foods (founded in 2008 and 2009 respectively) focused on perfectly replicating meat using plants.

And arguably this category hogged the limelight in 2013 when Bill Gates after trying Beyond Meat’s plant-based chicken said, ‘What I was experiencing was more than a clever meat substitute. It was a taste of the future of food.’ Since then, several startups have been trying to build solutions that mimic the taste, texture and flavor of meat products.

Interestingly, the cultivated meat became a reality in that very year when Professor Mark Post, a Dutch pharmacologist, decided to cultivate the first beef burger. And since then at least a dozen companies have debuted chicken, yellowtail, duck, minute steak, pork sausage, salmon, foie gras, kangaroo, fish maw, and more.

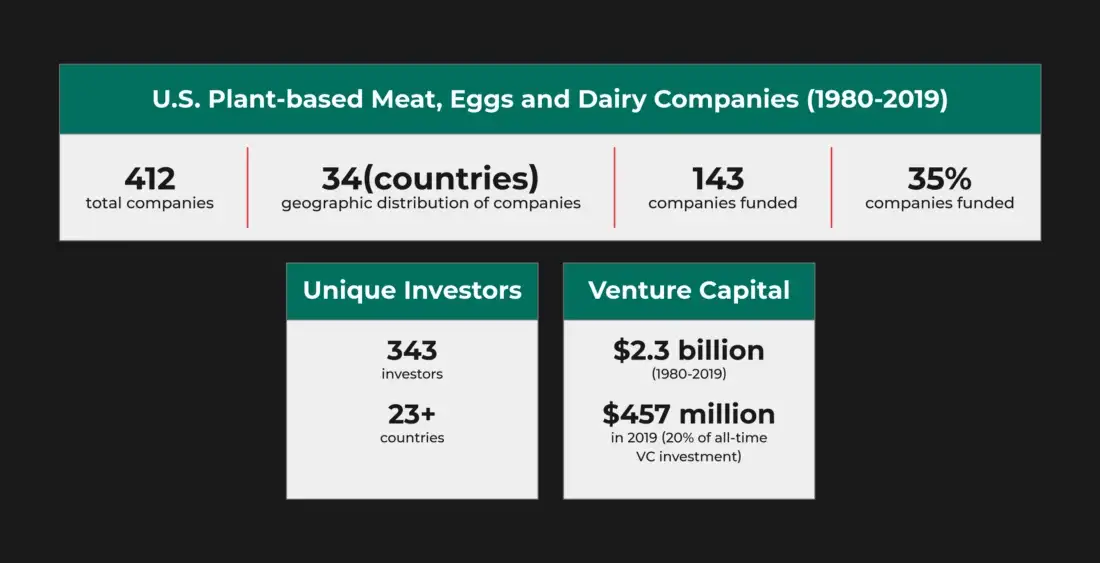

Source: GFI’s custom PitchBook analysis of plant-based food companies (including fungi and algae) either based or selling in the United States; and State of Industry Reports (2019) on Plant-Based Meat, Eggs, and Dairy and Cultivated Meat

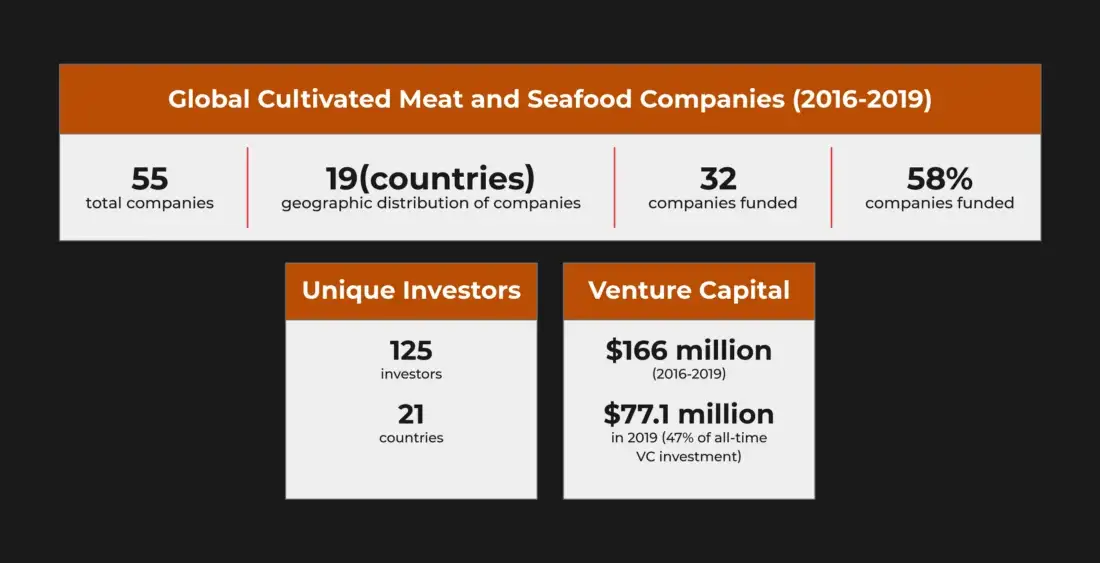

Source: GFI’s custom PitchBook analysis of cultivated meat companies globally, not including companies that pursue cultivated meat as part of a larger business; and State of Industry Reports (2019) on Cultivated Meat

Amongst the front runners of this sector — are some of the multinational companies that are actively pursuing opportunities to invest or partner with the startups in the sector; whereas some of them have also launched their own line of alternative protein products.

These companies include the world’s leading meat processing companies — Tyson, Cargill, JBS and Smithfield; food and beverage giants — Nestlé, Pepsico and Kraft Heinz; and also the leading life science company — Merck.

COVID-19: Tailwind for the Alternative Protein Sector

Lastly, with every zoonotic or animal transmitted disease, the first supplement to abandon our diets are the animal-based foods. While it is still uncertain how long this pandemic might last, there are certainly many people looking for safer alternatives for animal proteins. This has, in a way, created an inflection point for the sector globally.

Some instances include [5]:

In April 2020, Impossible Foods announced its plans to expand into 777 more grocery stores throughout the US, as Americans are cooking more at home amid the pandemic.

In March 2020, the Plant-Based Foods Association (PBFA), the trade association which represents 180 plant-based food companies, partnered with Dot Foods, the North American food company, to increase the access for plant-based foods in North America.

In May 2020, the Spanish meat analogue brand, Heura, expanded its distribution in supermarkets despite lockdowns. Heura has expanded its retail distribution by 13.7% in Spain with more supermarkets during the lockdown.

In May 2020, Green Monday (China), a plant-based product startup, claimed that its online sales have more than doubled in the last two months, citing the impact of COVID-19. Among the most popular purchases was a pork substitute called Omnipork, used in dumplings, noodles, and rice.

In May 2020, Beyond Meat, a plant-based meat producer, witnessed a 141% increase in its revenue over the previous year.

At CIIE.CO, we are actively exploring this space, that we believe has the potential to substantially replace animal-based food products. Feel free to reach out, share your thoughts or discuss exciting ideas at soniyas@iima.ac.in.

CIIE.CO has partnered with The Good Food Institute — India in a first-of-its-kind Smart Protein Innovation Challenge aimed at educating and enabling the brightest young minds in the country — to innovate in smart protein. This challenge was launched on 5th June, 2020 (World Environment Day).

References [1,2] Animal Agriculture Damaging Environment. (2020, May 15). World Animal Foundation. Retrieved from https://www.worldanimalfoundation.com/advocate/farm-animals/params/post/1280010/animal-agriculture-damaging-environment [3] United Nations, Food and Agriculture Organization. (2018). The future of food and agriculture: Alternative pathways to 2050. Retrieved from http://www.fao.org/3/CA1564EN/CA1564EN.pdf [4] United Nations, Department of Economic and Social Affairs, Population Division. (2017). World population prospects: The 2017 revision, key findings and advance tables. (Working Paper No. ESA/P/WP/248). Retrieved from https://population.un.org/wpp/Publications/Files/WPP2017_KeyFindings.pdf [5] Meticulous Research. (n.d.). COVID-19 Impact on Alternative Protein Industry: Meticulous Research® Viewpoint. Retrieved July 7, 2020, from https://www.globenewswire.com/news-release/2020/06/01/2041606/0/en/COVID-19-Impact-on-Alternative-Protein-Industry-Meticulous-Research-Viewpoint.html